Is the sun tax still existing in Spain? Who has to pay it? What is backup toll? When was the sun tax eliminated? We explain everything you need to know about this tribute that existed for self-consumption in the country.🔆😊

What is the sun tax?

Fortunately, we can talk about what the sun tax was, since this tax has been a current tax in Spain from 2015 to 2018. It was also known as "support toll" or "tax on self-consumption".

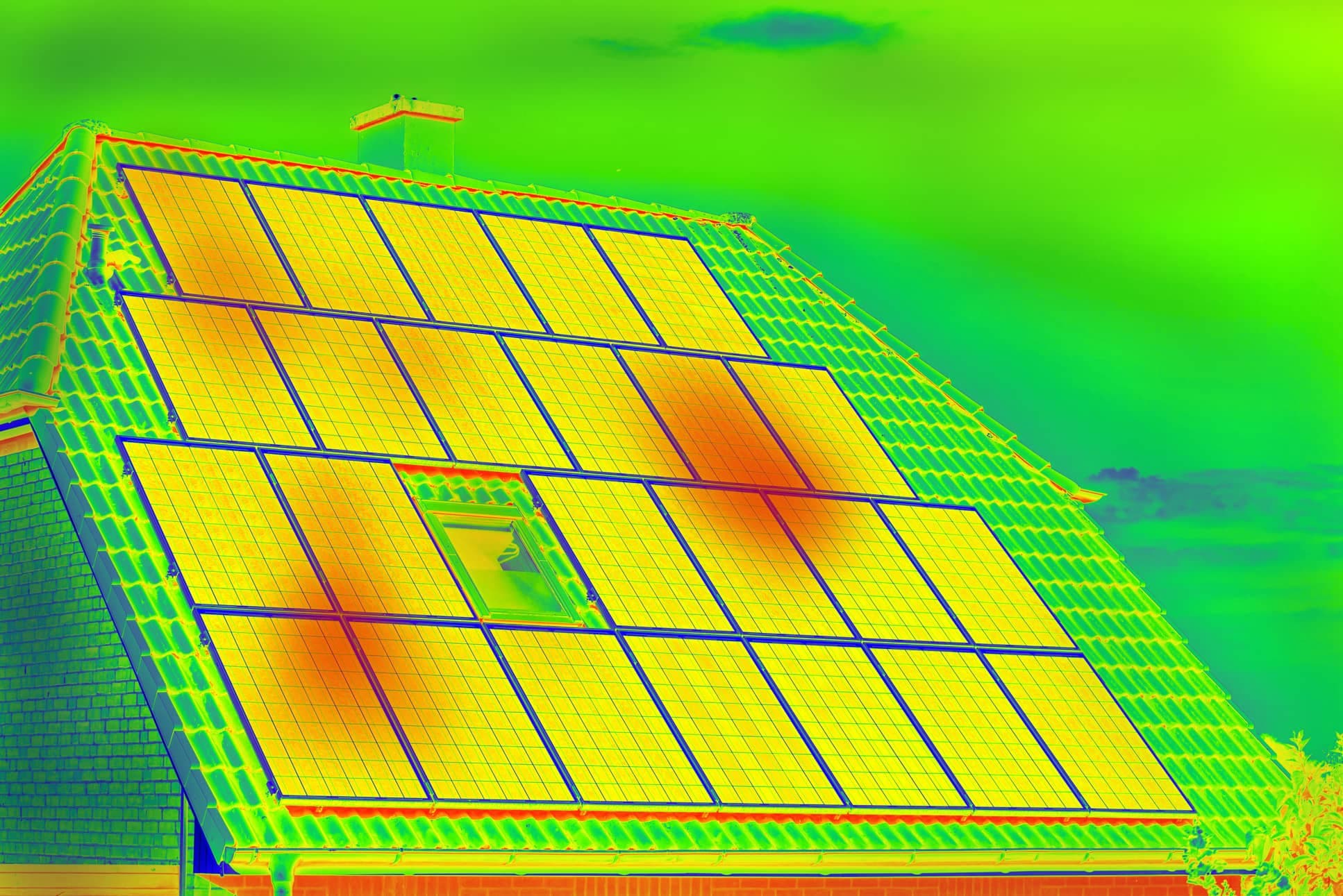

This sun tax consisted of a fee that users who had self-consumption with solar panels had to pay, due to they were connected to the electricity grid, and it was justified by the fact that it contributed to maintaining the traditional electricity system. In other words, to ensure that it remained sustainable for consumers who generated their own clean energy, but who would also use the grid when their solar system was not capable of generating power.

Who introduced the tax on the sun?

The tax was introduced by the Minister of Industry, Energy and Tourism (José Manuel Soria) of the Popular Party (PP) on October 9, 2015 during the government of Mariano Rajoy, through Royal Decree 900/2015, which regulated the administrative, technical and economic conditions of the modes of electricity supply with self-consumption and production with self-consumption.

Users paid this tax through the electricity bill to their marketer and then it later paid what corresponded to the distributor, who was in charge of placing that money in the electrical system.

This tax generated a great deceleration in the self-consumption goals that the country had, also making the process of legalizing a photovoltaic installation very complex. Another factor that has influenced this scenario has been that the users of a solar panel installation did not receive any compensation for the excess energy they generated.

Who should pay the sun tax in Spain? Who was affected by this tax on solar self-consumption?

The sun tax was paid through two concepts that were differentiated in the electricity bill:

- Power: applicable in large installations over 100 kW, or when the system included storage batteries.

- Energy consumption: applicable to the difference between the energy produced with the solar panels and the surplus of the same discharged to the conventional electrical network.

✋And here we make a clarification! If you don't remember the concept of kW of power or kWh of energy very well, don't worry, you can always come back to our Solar Guide: Difference between solar energy and solar power!🤓

Let's keep going!

On the other hand, the following cases of facilities were exempt from paying the tax:

- Installations with less than 10 kW of power (most households): therefore, installations with powers greater than 10 kW (generally companies) did have to pay the fee. For this reason, self-consumption with solar panels, the fact of reducing costs and generating their own clean energy ceased to be seen as an interesting alternative for companies that had to pay the tax.

- Isolated photovoltaic self-consumption installations: those that were not connected to the electricity grid.

- Installations in the Canary Islands, Ceuta and Melilla.

What happens next? When is the sun tax eliminated?

After three years of controversy, the sun tax was repealed in 2018 with the arrival of the new government of Pedro Sánchez through Royal Decree-Law 15/2018.💪

Do not miss this witty video made by Greenpeace Spain in 2018, made up of several fragments of real phrases by Mariano Rajoy himself, highlighting the meaning of renewable energy and the famous -and controversial- tax on the sun.

In this way, the Minister for the Ecological Transition, Teresa Ribera, pointed it out in 2018:

“This measure seeks to alleviate Spain's delay in this matter, since it is not logical that a country rich in sun like Spain has 1,000 installations, compared to the million that Germany has. There's a long way to go."

It has been like this then, as Royal Decree 244/2019 of April 5, which regulates the administrative, technical and economic conditions of self-consumption of electrical energy, has given continuity to what is established in Royal Decree-Law 15/2018 , and it is the regulation that we have still today. It has recognized the right of self-consumption without tolls or charges.

Fortunately, this reform and end of the tax has brought some important measures to highlight, such as:

✔️Promote self-consumption and bet on renewable energies

✔️Simplify and reduce administrative procedures for facilities

✔️Eliminate complex barriers that made self-consumption difficult and did not encourage

✔️Compensate small consumers for surpluses

✔️Approve collective and shared self-consumption in neighborhood communities (good news in a country where vertical housing predominates)

✔️Speed up the amortization of the investment in photovoltaic installations

✔️Eliminate the generation counter in installations without discharge

✔️Allow installations with power less than 10 kW and those isolated not to have to request permits from the electricity companies

The end of the tax has brought important savings measures for consumers.

Surely you have already heard on more than one occasion that Spain is the country with the greatest potential in Europe to take advantage of solar energy, both due to its climatic conditions and the solar radiation it receives. Thanks to the repeal of the sun tax, citizens' confidence in self-consumption has grown and a large increase in photovoltaic installations has been generated.

According to data recorded by the Spanish Photovoltaic Union (UNEF), in 2021, 1,203 MW of new photovoltaic power were installed in the country in self-consumption facilities. This figure is an increase of 101.84% compared to the previous year (596 MW). 📈 Of these 1,203 MW, it is estimated that 1% corresponds to installations isolated from the network. UNEF also indicates that most of this new capacity has been installed in the industrial sector (41%), then in the residential sector (32%) and finally in the commercial sector (26%).

If like all these new owners of photovoltaic systems, you too are considering installing solar panels or batteries for your home or business, we help you compare before you buy solar products and get quotes from installers quickly and easily here.

At Quiero Sol we help homeowners like you, so that they can compare installers but also understand the concept of photovoltaic self-consumption and the different scenarios that have existed and exist in Spain regarding the solar industry.🌞