Solar panel financing

Financing Options for Solar Panels

Initiating a home energy efficiency improvement project is an exciting opportunity to contribute to a more sustainable future. While it is true that these initiatives may require a significant upfront investment, there are a number of financing options and grants available that make this important step toward energy efficiency available to more people. Exploring these alternatives can open the door to valuable long-term benefits for both our pocketbook and the planet.

To try to encourage the energy transition, a set of grants and subsidies have been established that are an attractive hook to convince the hesitant to face an investment like this; in addition, it is something that will report a direct economic benefit, once the installation is completed, with the reduction already in the first month of our electricity bill.

As the macroeconomic context is favorable for this, several financing modalities have emerged specifically prepared for the renewable energy sector. The main banks operating in the country have been concerned to bring out the corresponding products and the companies working in the sector, being aware of this, have rushed to establish partnerships with the same entities to facilitate decision-making, when the main impediment is the economic factor and the disbursement of amounts sensitive to our portfolio.

Without any doubt, having a healthy credit situation, financing solar panels will be a relief for our pocket. Not only we will establish feasible monthly installments for our economy, but we will avoid having to disburse a large amount; in addition, taking into account the amortization and the immediate reduction in our electricity bill, it is not too hard a blow. Besides obviously the great contribution to the preservation of the environment.v

Banks that finance solar panels:

BBVA:

Product: Préstamo de Eficiencia Energética

Probably one of the best options for financing solar panels. We have the stability of the contractual conditions of a bank; fixed (and balanced) interest rates; sufficiently long terms so as not to result in very high monthly payments; no direct deposit of salary is required; the amounts are large enough to cover any type of installation and it is designed to be able to deal with the wide range of possibilities for improving the energy performance of our home.

Santander:

Product: Préstamo Verde

Another very good option. The good situation of Santander bank in the market makes it one of the options that transmits more tranquility. With very similar conditions to those of BBVA, even with the possibility of accessing a larger loan amount. However, a direct deposit of your salary is required and there is a set-up fee of 1% of the amount requested, which could make this option the second best among banks that finance solar panels.

HolaLuz Installations: Special Conditions with Santander:

In this case we find a slight improvement of the Santander loan conditions, but subject to the contracting of HolaLuz to carry out the installations. The improvements correspond to the elimination of the opening fee; to an extension in the loan repayment periods, but the amount to be requested is much lower and totally subject to the contracting conditions of HolaLuz for the issues related to photovoltaic. Which implies the subscription model to your electricity supply. If HolaLuz is not our best option to install, this type of financing of solar panels is not the most suitable for us.

La Caixa:

Product: Wivai + EDP

The lowest NIR and APR in the market. That is already an incentive. However, La Caixa is known to be one of the banks with more extra commissions per operation and limits the options where to apply the loan. In addition, you must be a client of the bank and have your salary paid directly into your account. The “French amortization” system is not the most appropriate for this type of investment because you pay more interest than capital during the first installments, and this is the modality they promote. For a loan from a financial institution, it does not exactly meet the best market conditions in terms of banks that finance solar panels.

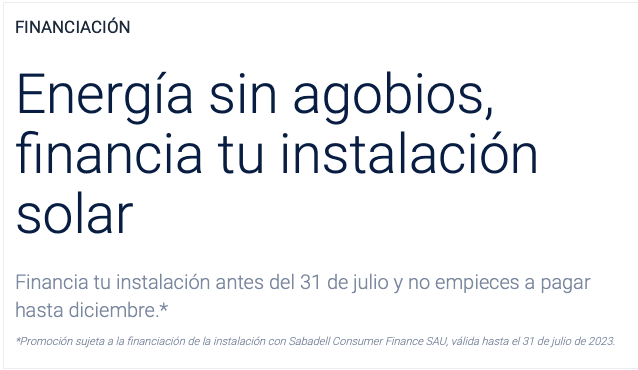

Sabadell:

Product: Préstamo Sabadell ECO

The option of financing solar panels from Banco Sabadell has quite high interest rates (the highest of the banks that finance solar panels) and added to the opening fees (and study!) make Sabadell the least recommended option of the banks. They do not ask for direct debit of your salary, but not only must you be a client, but you must be a client for more than 6 months, which implies the corresponding delay in the installation, or a previous planning. The last of the banks to establish an “eco” loan and the one that has set the most complex conditions. Being a client of the bank you can soften these conditions, but even so, it is far from the conditions that BBVA or Santander can propose.

Large Electricity Retailers

HolaLuz

As referred to in its special conditions with Banco Santander.

Endesa X (FECSA/ENDESA):

They associate everything related to the financing of solar panels and renewable energy loans to the Green Loan offered by Santander bank. However, you do not have the same conditions as if your installer is HolaLuz.

Iberdrola (Smart Solar):

In this case, the competition between the large marketers continues and is reflected in the banks with which they collaborate on financing issues. Iberdrola collaborates with BBVA. Everything related to financing refers the client to the Energy Efficiency Loans of this entity.

Naturgy:

Product: Naturgy Solar

It is true that they offer three different options and seem to provide some flexibility to the option; however, the different options are not very different from each other and only the La Caixa option seems to have a somewhat more defined structure of what the loan conditions may be.

Summary of solar panel financing with major retailers

In summary, as far as the financing of the major suppliers is concerned, they only compensate in their various modalities in the event that we are already their customers. The fact that we are talking about a subscription-based contracting model greatly conditions the context in which it may or may not be more beneficial to take one of their options than some of the other possibilities offered by the market.

However, in the case of being already customers of the supplier that is going to make the installation, the options can be very comfortable, flexible and really soft for our monthly economy. However, we are still at the mercy of those who stipulate the energy prices and this will happen with all the derivatives of the installation.

Other companies in the industry

Naturally, we can not only finance our solar panel installation with financial institutions, but also with other companies in the sector.

In Quiero Sol we always advocate for total transparency towards our customers and we want to show ourselves as a trusted advisor in the sometimes complicated world of renewable energies. That is why we are going to give you a transparent breakdown of the options available in the sector.

Contact an expert advisor

If you have any questions regarding the financing of solar panels, please do not hesitate to contact one of our solar experts.

Octopus Energy:

The lack of information leads us to believe that the only clear conditions of your financing are about the effective period of the loan and the start of installment payments.

It is understood that this is the profile of a company that offers financing, but does not want to assume certain risks. It is understood that everything is subject to a prior financial health study so that the corresponding department can decide whether or not to make the project viable or not.

Fuente: Octopus Energy

Otovo:

All matters relating to the financing of solar panels are referred to the BBVA Energy Efficiency Loan.

Sunhero:

1st Financing Option:

Bankinter Consumer Finance, E.F.C, S.A.

Product: Préstamo Comunidad

One of the first options redirects to Bankinter as a collaborating financial entity. It is not a bad option in case we are talking about installations focused on communities of neighbors, since they offer a 12-year amortization and amounts capable of covering installations of this size; but we have to add the complexity of coordinating a whole community of neighbors, getting everyone to agree on the amounts and managing all the documentation.

2nd Financing Option:

Banco Santander “60-month special conditions”:

A fixed NIR and an APR to be specified are the main discrepancies with Santander's other offers. To be repaid over a fixed term of 5 years and with the same standard penalties. However, it is subject to the restriction that the installer must be Sunhero.

Only recommended if you want your installer to be Sunhero, because the conditions they have with their Green Loan are better.

3rd Financing Option:

Banco Santander “144-month special conditions”:

Longer period for the loan, but it will depend entirely on your financial health what contractual conditions the loan will have, since both TIN and APR will be subject to study by the entity.

4th Financing Option:

WiZink - ECO Program:

Everything that corresponds to “non-official” credit entities is not recommended because of the interest and penalties for delay. In this case we do not find abusive conditions or very out of market, but they are still more restrictive conditions than those of the banks.

Sunalizer:

Leasing Option and Renting Option:

Sunalizer:

Leasing Option and Renting Option:

Neither of the two options seems too valid. Between the different interests (again subject to study) and the payment conditions, the conditions are not so favorable, considering that you will NOT be the owner of the installation that will be in your house. It is true that it means a less shocking disbursement for our monthly economy, but, in the long run, it hurts as much as a mortgage.

Purchase Option:

It is very curious that the installer itself, in case you have either the amount in cash or a good situation to finance, directs you directly to the banks. As it was commented in the summary of this article, the contractual conditions, interests and clauses corresponding to the loans issued by banking entities are the most balanced and feasible. And with fewer surprises.

SolarPlus:

First direct competitor that does not offer any type of information regarding financing and does not offer any possibility of referral or referral to another company that could take care of it.

SotySolar:

1st Financing Option:

Financing Model 3x3:

It is a good option to divide the total amount of the installation in three payments. If you have a good amount of cash and a regular income, it is not a negligible option at all. With no interest and no extra costs, in the event that the constraint is not really restrictive, it is a very good way to soften the payments, but not to commit for life.

2nd Financing Option:

Short-term financing:

It is more of a commercial hook than a real financing option. From 12 to 24 months... no interest or set-up fees... “Contact us if you want to know more...”; this is a call to leave our data.

It offers nothing different from its previous option.

3rd Financing Option:

Long-term financing:

We are going to an option with interest and “possible” extra expenses... but again, “Contact us if you want to know more...”... Not that it conveys a lot of confidence.v

Again, if your financial situation is stable and healthy, it is preferable to consider one of the options directly with the bank and without conditions from the installer. This will give you more freedom to combine contractual conditions and desired installer.

Compara antes de financiar!

Fuels Companies

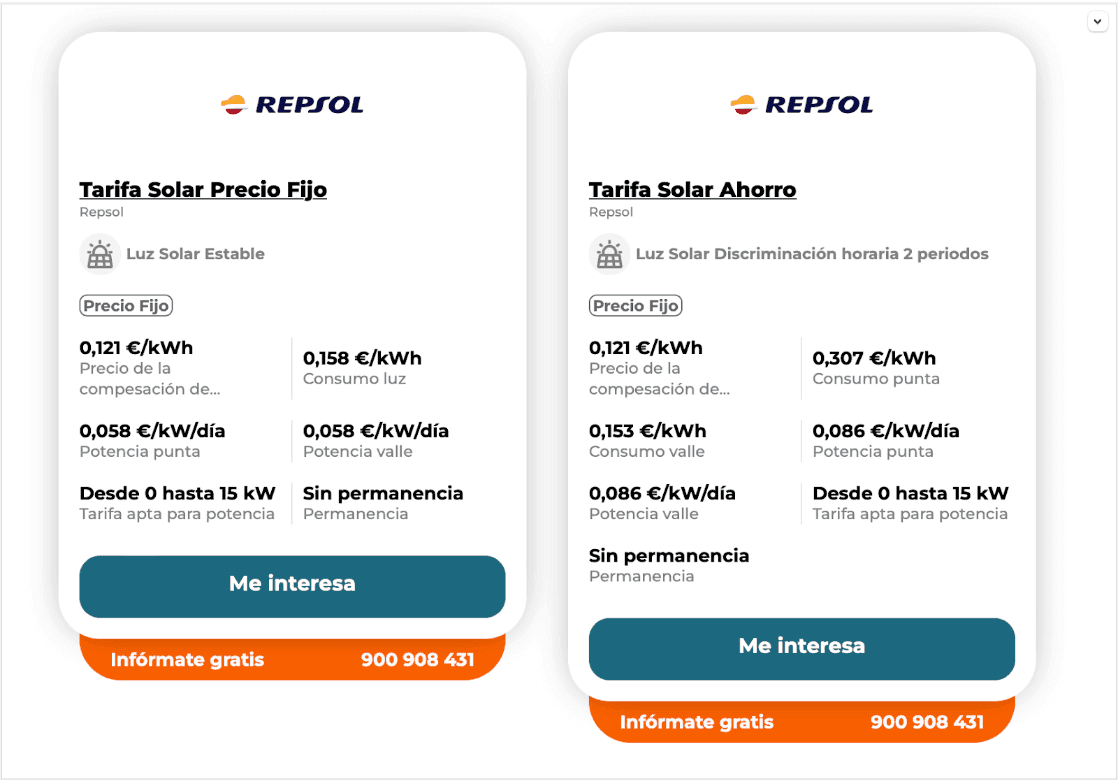

Repsol/Movistar (Solar360):

It is not a financing option in itself... everything is bundled into a system of rates that can be modified according to the conditions contracted.

You only manage to find a small table, with very small print, which mentions the Sabadell ECO Loan. But it is not possible to decipher, depending on where it is found, at what point the price of the installation and its financing can be related to the rates that they market.

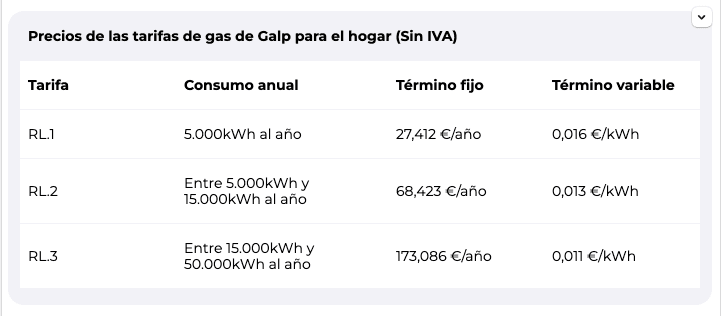

Galp:

Exactly the same system as Repsol.

And likewise, there is also a small, imperceptible box commenting on financing. There is no further reference to it anywhere on their website.

In both cases, as with the large marketers, we are talking about a subscription model, so we are never talking about real financing, but rather about stipulating the conditions that will affect the time we receive our energy bill. Again, if you are already a customer of these companies, it is not a bad option; however, there are much more favorable contexts among the other possibilities in the market. v

Credit Institutions:

Cofidis; Cetelem; Fintonic; Creditea; Préstalo…

We could go on and we would have an endless list of “unofficial” credit companies.... Without being disrespectful and trying to approach it with as much affection as possible; I can't think of any context in which it is recommended to access this type of credit companies.

According to the dictionary:

What is it to be a loan shark?

“A person who engages in lending money, goods or services by charging a high fee or excessive interest.”

A very small amount, with the certainty of paying it back in a minimum period of time, with extreme urgency and in a “life or death” situation are the only context in which I would recommend this option. Some newer companies, adapted to the new times and set up from a much more serious and professional point of view of the business can get a pass, for their seriousness and coherence at the time of working. However, most companies correspond to a very old operating model, almost obsolete, without ethics or morals and willing to take advantage of anyone who does not understand the operation of fees and interest on arrears. If this must be your option, do not install.